CollectiveSun Solar Spotlight:

San Diego State University Associated Students Aztec Recreation Center

San Diego State University is committed to promoting the use of solar energy as part of its commitment to sustainability. The university’s student-run Associated Students organization has been a strong solar champion, motivated by the students’ desire to make their campus more sustainable.

Associated Students goes beyond what many such student associations do. Not only does the organization advocate for student voices — it also manages various facilities and produces social, recreational, cultural, and educational programs. Most of the buildings that Associated Students operates are funded by the students, and the students have the authority to make major and minor decisions about their facilities.

The Solar Journey

Associated Students’ solar journey began in 2008 with a solar installation on the Associated Students Mission Bay Aquatic Center, which became the first commercial-scale facility in San Diego to achieve net energy zero and the first Associated Students structure to be certified LEED Platinum.

The students then set a goal for all their buildings to be net zero electricity by 2020; despite the pandemic slowing down progress on that goal, 1 megawatt (MW) of solar has been installed so far on various Associated Students buildings and parking structures, and all of the larger buildings operated by the organization have become LEED certified.

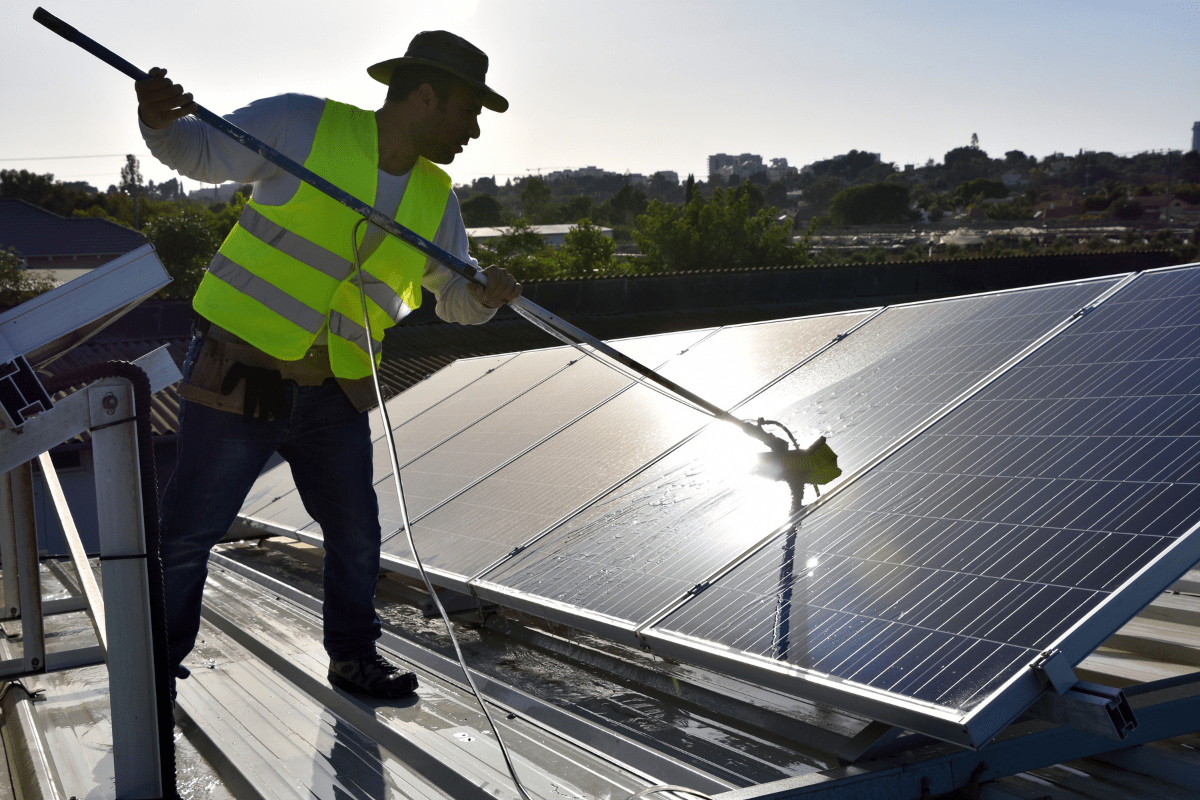

The most recent solar addition is at the Aztec Recreation Center, which underwent a remodel that involved removing all natural gas and making the facility all electric. The Aztec Recreation Center already hosts 250 kilowatts (kW) of solar, and Associated Students is now adding 750 kW to support the increased electrical load — 650 kW on an adjacent parking structure and 100 kW on the roof of a new building of the Center.

|