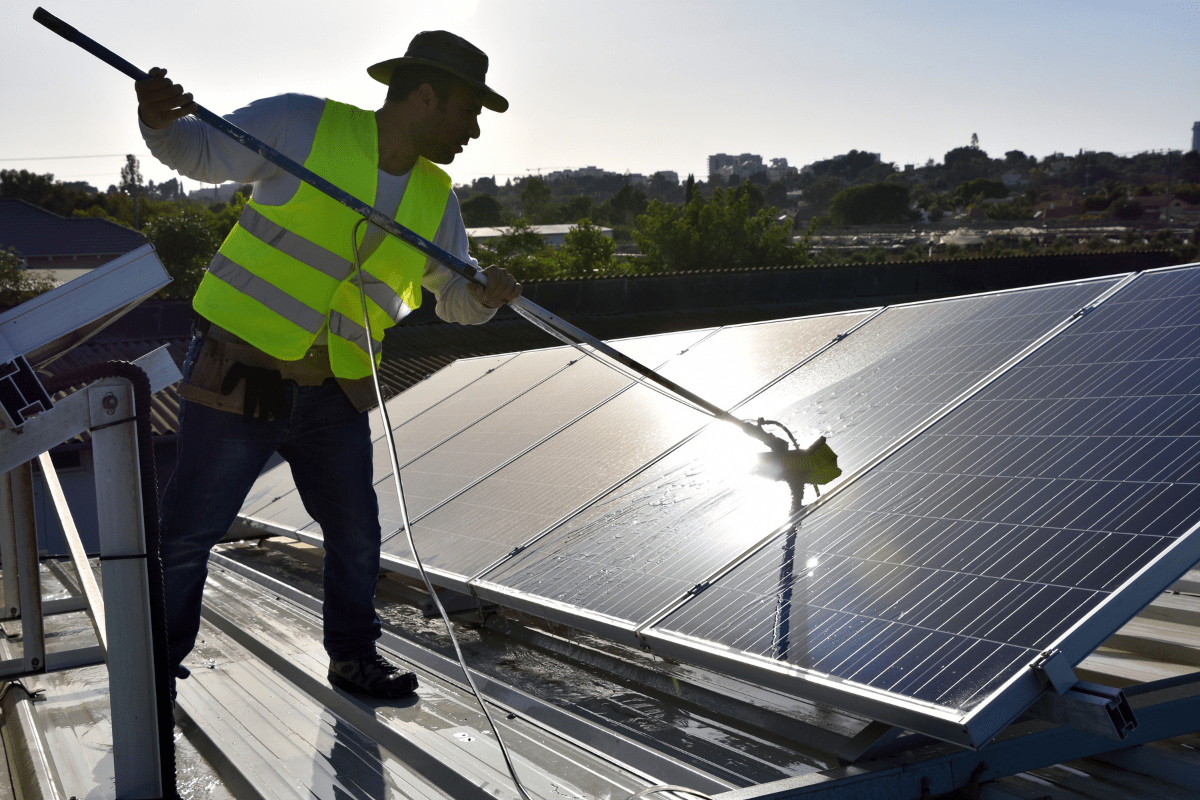

When President* Trump first proposed new tariffs on imported solar panels, industry stakeholders predicted that solar installations in the US would grind to a halt. The worst has yet to materialize. The rate of solar growth slowed last year but it is picking up again, and the US solar industry could emerge stronger than ever.

In one sign of things to come, new financing instruments are beginning to crack open the market for solar installations at nonprofits and other tax-exempt organizations.

The untaxed sector has been relatively slow to adopt rooftop solar, partly because conventional tax benefits don’t apply to organizations that don’t pay taxes in the first place.

One new workaround is a commercial financing model for rooftop and ground-mounted PV installations called Collective PACE™, launched this week by the green financing leader Greenworks Lending and nonprofit solar specialist Collective Sun.

The new model leverages two instruments that were once fairly exotic, but are now familiar fixtures in the energy efficiency and renewable energy fields.

One is C-PACE ( Commercial Property Assessed Clean Energy), which provides commercial property owners with access to low-cost financing for energy-related upgrades. The up-front costs are financed through a voluntary assessment on the property. If all goes according to plan, the assessment is offset by lower energy costs.

No money down is also the operating principle for PPAs (Power Purchase Agreements). With typical PPAs, property owners have rooftop solar installed by a third party that owns the equipment. The cost is paid off through the property owner’s utility bill. Ideally, the property owner’s bill goes down and the end result is a “free” rooftop solar installation.

Combine the two, and the result is a third-party lease agreement:

“Collective PACE™ delivers a discount to nonprofits through the upfront monetization of tax incentives by the third party, while simultaneously allowing nonprofits to take advantage of the longer-term, lower-cost financing available through C-PACE.“

Collective Sun and Greenworks also cite benefits over and above the direct advantages of rooftop solar:

“…Charitable rating organizations such as GuideStar can look more favorably upon an organization’s financials when less contributed revenue is allotted to operations vs. core services provided. Further, the burden on development departments and donors to fund new construction or other needed capital improvements is reduced when financing can cover 100 percent of a solar investment.“

C-PACE financing is not available in every state. As with rooftop solar policies, the situation can vary considerably depending on state-level legislation.

That could change because US Department of Energy is very much in favor of C-PACE as a matter of national policy. That’s interesting because the President has been vociferous in his support for coal-sourced electricity, while C-PACE aims in exactly the opposite direction.

Nevertheless, earlier this year the Energy Department issued a report optimistically titled, Lessons in Commercial Leadership: The Path from Legislation to Launch. The goal is clear:

“Lessons in C-PACE Leadership aims to fast track the set-up of commercial property assessed clean energy (C-PACE) programs for state and local governments by capturing the lessons learned from leaders.”

The Energy Department singles out Texas, Connecticut, and California among the nation’s C-PACE leaders.

The agency is also interested in promoting R-PACE for residential properties. The challenges for rooftop solar financing are different in the residential sector, but there is also a major new opportunity in R-PACE:

“A PACE assessment is a debt of property, meaning the debt is tied to the property as opposed to the property owner(s)…This can address a key disincentive to investing in energy improvements because many property owners are hesitant to make property improvements if they think they may not stay in the property long enough for the resulting savings to cover the upfront costs.“

Consider that the average US resident moves more that ten times in their lifespan, and you can see where the limitations of PPAs come in. If the rooftop solar financing is attached to a person’s utility bills, they would likely move before they realize any significant benefit. PACE closes that gap and incentivizes energy upgrades regardless of how long (or short) a person owns the property.