Three Things Nonprofits Need to Know About the Inflation Reduction Act’s Direct Pay Provision

Clean energy in the U.S. has largely been incentivized by tax credits — most notably, the Investment Tax Credit (ITC) and the Production Tax Credit (PTC).

Tax credits are great, because they basically act as a rebate on the cost of your project. But before the passage of the Inflation Reduction Act (IRA) over a year ago, tax credits were available only to taxable entities. That left tax-exempt and government entities, such as nonprofits, churches, and schools, out of the equation. These entities could go solar via a lease or PPA, but they couldn’t directly take advantage of the ITC.

That’s all changed with a feature of the IRA that we think deserves a special place in the Tax Credit Hall of Fame: direct pay.

The Tax Credit Hall of Fame may not exist, but direct pay is very real, and it could have very real positive impacts for your nonprofit. For the first time ever, direct pay allows nonprofits to receive a payment that’s equal to the full value of tax credits when they build qualifying clean energy projects.

You can get the basics on direct pay in this White House summary and in the Treasury guidance. (Treasury also calls it “elective pay.”) Here, we’ll cover three potential direct pay challenges for nonprofits — and solutions to those challenges.

This information applies to most nonprofit solar projects that are under 1 megawatt (MW) and that use the ITC rather than the PTC. That’s the case for most nonprofit projects, but if yours doesn’t fall in this category, don’t hesitate to contact us.

Direct pay challenges

As great as direct pay is, it does come with a few challenges. Fortunately, they are surmountable, but it’s important for your nonprofit to be aware of these pitfalls.

Timing

Direct pay is not a cash grant. That means that direct pay will be associated with a tax return filing, and your nonprofit will need to file a number of tax documents to receive the payment, even if your nonprofit enjoys a religious exemption from otherwise filing tax returns. It also means that there could be a lengthy payment timeline and delay in receiving the payment.

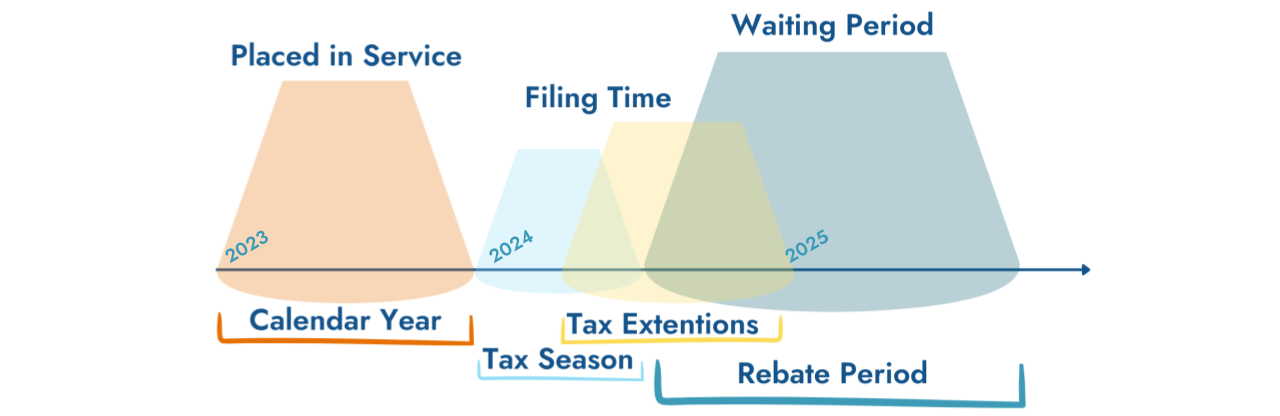

The timeline begins when your project is placed in service, not when construction starts. As the following timeline example shows, if you place your project in service at the beginning of tax year 2023, you’ll have to wait till tax filing time in 2024. Then, a waiting period for the rebate begins when your tax return is filed. That means you might not see your rebate for 18 months or even 24 months from when your project is placed in service. The contractor for your project, on the other hand, will expect payment much sooner. That creates a funding gap period.

Excessive benefit

A new issue that was not in the IRA bill text but was included in the Treasury guidance is the concept of excessive benefit.

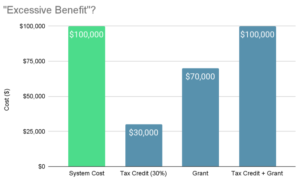

The idea here is to prevent nonprofits from supposedly benefiting excessively from direct pay. What that means for you as a nonprofit is that if you get a grant or donation that is specifically earmarked for your solar project and covers 100% of the project costs, you become ineligible for direct pay. If the grant or donation covers part of the project costs, that’s factored into the amount of direct pay you can get. The grant or donation plus the direct pay amount can’t exceed the purchase price of the solar project.

In this example, if you got a grant or donation for more than $70,000, that excess would be deducted from your $30,000 direct pay tax credit.

Keep in mind that this doesn’t apply to general grants or donations to your organization that aren’t earmarked for solar; it’s only an issue for funds that are earmarked for a solar project. According to the definition of earmarked funds in the Treasury Proposed Regulations, that means “Tax Exempt Amounts for the specific purpose of purchasing, constructing, reconstructing, erecting, or otherwise acquiring an investment credit property.”

Audit risk

It’s nothing new that the IRS can audit you. Yet there’s a section in the Treasury guidance warning everybody about the possibility of being audited.

The inclusion of this already-known fact underscores the importance of being accurate and detailed in your tax filings, and ensuring you’re following all the rules for direct pay.

Direct pay solutions

Fortunately, CollectiveSun has solutions for these direct pay challenges. Through our nonprofit-centric financing, nonprofits can finance solar projects with a lease or a loan. That removes the timeline issue, because there’s no upfront payment for either of these options and therefore no funding gap. It also removes the excessive benefit issue, because the project can be funded completely or in part by the lease or loan.

CollectiveSun’s Solar Loans, designed specifically for nonprofits, is Direct Pay–ready. The solar loan is a loan made directly to your nonprofit with no repayments due during construction, no collateral needed beyond the solar equipment itself, and no prepayment penalties. You hire a solar installer directly and own the system. With this option, you can claim the direct pay benefit directly.

Our Leases utilize direct pay, and since the system is owned by us, we claim the direct pay benefits and handle all of the paperwork and filings. With a lease, your nonprofit also avoids having to manage a complex construction project or perform operations and maintenance on your solar system once it’s placed in service. Under a lease, CollectiveSun Foundation (a 501c3 nonprofit) is the owner of the solar project and can claim tax benefits, which lowers your lease payment — so you get indirect benefits from the ITC. With this option you don’t need to worry about an audit risk, since CollectiveSun would be the one submitting tax filings and subject to regulatory scrutiny.

Whether a lease or a loan makes sense for your nonprofit depends on factors such as how comfortable you are managing a large construction project; there’s no one-size-fits-all solution. If you’d like more guidance on selecting the right option for you, please contact us.

For more information on direct pay, see our recent webinar.

Disclaimer: This information does not constitute legal or tax advice and should not be relied upon for any purpose. Please consult your legal counsel and tax advisor.