Financing can be one of the biggest hurdles for a solar project. Even if you understand solar basics and have the information you need to prepare your nonprofit for solar, you may run into this stumbling block.

But it doesn’t have to hold back your project. If you’re concerned about how to finance solar for your nonprofit, we have two pieces of good news:

- The Inflation Reduction Act (IRA) has opened up new financing options for nonprofits that can greatly reduce the cost of going solar.

- CollectiveSun specializes in financing! Because we are committed to increasing access to solar financing for nonprofits, we go beyond helping you navigate the options — we can also finance your project, if that’s the route you choose.

The Inflation Reduction Act

Clean energy in the U.S. has largely been incentivized by tax credits like the Investment Tax Credit (ITC). These are financial incentives that reduce the cost of your project by lowering your tax obligations. Before the IRA passed, tax credits were available only to taxable entities. That left nonprofits, churches, and schools out of the equation. These entities could go solar via a third-party ownership arrangement such as a subscription model or power purchase agreement (PPA), but they couldn’t directly take advantage of the ITC.

That’s all changed with the direct pay feature of the IRA. There are still some nonprofits that prefer third-party ownership options, but for the first time ever, direct pay allows nonprofits to receive a payment that’s equal to the full value of tax credits when they build qualifying clean energy projects through a refundable tax credit.

What’s more, the IRA added various bonuses to the 30% tax credit that can potentially raise the credit as high as 70%. While those cases are rare, it is often possible to go beyond the base 30% credit.

If you purchase your solar with cash or a loan, you can take advantage of direct pay — directly! If you use a third-party financing option like CollectiveSun’s Solar Power Agreement, we’ll handle the tax credit and pass savings along to your organization. For more on direct pay, see our Inflation Reduction Act page.

Solar financing options

Nonprofits have always faced barriers when trying to access traditional sources of financing. Banks and other lenders have a biased perception about the risk of lending to nonprofits, which has made it difficult for nonprofits to access loans from traditional banks at attractive rates. CollectiveSun is removing these financing barriers.

Every nonprofit is unique, so nonprofits need a diverse range of financing options. We offer both loans and third-party ownership options to make solar energy more accessible and cost-effective for your nonprofit.

Solar Loans

A lending option may make sense for a nonprofit that wants to own its system but does not have the cash to purchase it outright.

The CollectiveSun Solar Loan — designed by nonprofit professionals, not traditional bankers — supports your nonprofit’s purchase of a solar system while allowing you to benefit directly from the direct pay tax rebate.

CollectiveSun’s interest rates are based on community impact, not just your nonprofit’s credit score. The approval process is quick and easy, and our loans come with fund control, which is a construction management process where we disburse loan proceeds according to a milestone schedule in order to protect the nonprofit organization.

Solar Power Agreements: the Easy Button

CollectiveSun also offers third-party financing options as a solar subscription that make it easy for nonprofits to go solar — our “Easy Button” options.

While your organization won’t own the solar panels with these options, you’ll own all the energy they generate. CollectiveSun provides all construction management as well as full operations and maintenance, so you don’t have to worry about those risks. Leaving it to the experts means that it’s somebody else’s problem when things go wrong during the construction process, and somebody else takes on the long-term ownership risks. As with our Solar Loan, our solar subscription rates are based on community impact rather than credit scores.

Cash

If your organization has a grant or gift for your solar project, you may be able to purchase your system with cash. Keep these factors in mind:

- The “Excessive Benefit” rules may limit your ability to claim direct pay. The direct pay eligible amount is reduced to the extent that the restricted tax exempt amount plus the direct pay tax rebate exceeds the purchase price. For example, if your system costs $100,000 and is otherwise eligible for a 30% ITC, any amount of grants earmarked for solar over $70,000 will lower the direct pay rebate eligibility. If you received a grant for $100,000, the system would not be eligible for any direct pay rebate.

- You’ll save the most with solar if you buy your system. However, even with third-party ownership you’ll see solar savings. Instead of spending your cash on solar, you could be using it — plus your solar savings — to support your nonprofit’s programs.

Picking the right financing option for your nonprofit

Solar projects are construction projects, and with the tax rebates involved, the financing and tax filing can be complex. Your organization may be willing and able to handle all of that; if not, CollectiveSun can take care of it when you pick third-party financing through us.

If your nonprofit prefers to own your system, you may choose to finance it with a loan or cash. Keep in mind these important caveats:

- Your organization must have construction management expertise and be comfortable navigating the tax filing requirements.

- You’ll need to find solar installers and compare their quotes. If the installer you select for your project has not yet been vetted by CollectiveSun, that installer must submit a contractor application and meet our vetting requirements.

- You should be comfortable monitoring your solar system and handling any required maintenance, even if that means hiring contractors to do the maintenance.

- All of this work must be built into your budget for the project.

- You may need to rely on volunteers from your nonprofit or congregation to manage some of the work.

- If something goes wrong during construction, you will be responsible for managing insurance claims, finding a new contractor (if your selected installer becomes insolvent), and dealing with construction management hassles.

If your nonprofit is not well equipped to manage construction, financing, and maintenance, you might opt for the Easy Button “Solar Subscription” solution of a Solar Power Agreement. This option provides benefits beyond requiring no cash upfront. CollectiveSun will also select a vetted installer, undertake all contract negotiations, take care of tax filings, and provide monitoring and maintenance.

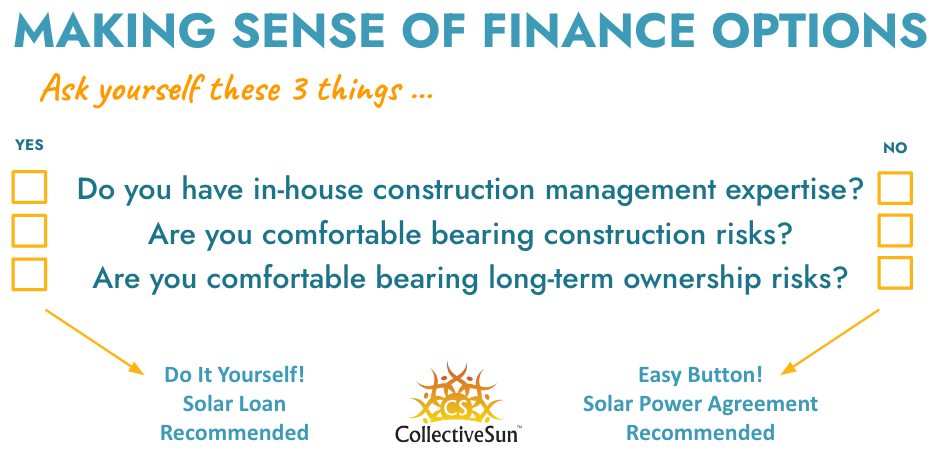

This figure can guide your nonprofit in picking the right solar financing option:

Tip: Involve a team of people at your organization to review the financing options, and ensure all key stakeholders are consulted — whether it’s the Board or members of a congregation. The Solar Subscription model may be a new concept for your organization, so you may need to hold more than one meeting to ensure it’s understood.

Getting help financing solar for your nonprofit

The world of solar financing can seem daunting, but it doesn’t have to be. You don’t have to navigate the options alone. CollectiveSun is here to help you before, during, and after your solar is installed, including financing your project.

Our team of seasoned experts has been focused on delivering solar financing solutions for nonprofit and tax-exempt organizations across the country for over a decade. In just the last few years, we’ve proudly facilitated solar projects for over 200 nonprofits spanning 25 states.

If you’d like help financing solar for your nonprofit, don’t hesitate to reach out to us.