We’ve talked in previous posts about how powerful the Inflation Reduction Act (IRA) will be in fueling a U.S. clean-energy boom. Already, the legislation has spurred hundreds of billions in clean-energy projects across the nation. A key component of the legislation is the various adders to the base 30% tax credit for clean-energy projects, which can add up to major savings in project costs. One of these, the 10% Energy Community Bonus Adder, was put in place to ensure that people in communities traditionally supported by fossil fuels are not left out of the clean energy transition.

This adder has an advantageous feature that sets it apart from the other adders: its simplicity.

If your project is eligible for the Energy Community bonus adder and you apply for it, you will get it. This is a bonus adder you can rely on. You can build it into the financial models for your project, with certainty that it will be applied — adding 10% to the 30% base tax credit for your project.

What qualifies as an energy community?

In the context of the IRA, an energy community is one that has historically been sited near coal, oil, or gas industries, and/or where a certain percentage of the tax base relies on these fossil-fuel industries. If your project is located within an energy community, it’s eligible for the adder.

There are three categories of energy communities, which we’ll delve into below:

- Brownfield

- Statistical Area (Fossil-Fuel Employment)

- Coal Closure

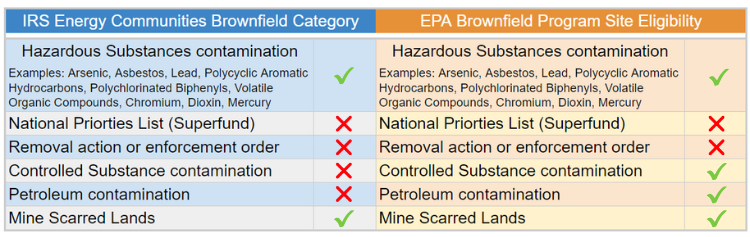

Brownfield Category

For the purposes of the Energy Community Bonus Adder, a brownfield is a contaminated site as defined in the IRA guidance from Treasury, which differs from the Environmental Protection Agency (EPA) definition.

A former gas station, for example, would not qualify as a brownfield under this guidance. Some landfills qualify, and others don’t.

Statistical Area Category

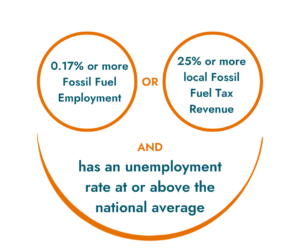

To qualify in the statistical area category, your project must be in an area that satisfies both of these requirements:

1) the area must either, at any time after December 31, 2009, have had 0.17% or more employment in fossil-fuel industries or 25% or more local tax revenues from fossil fuels, and 2) it must also have a current unemployment rate at or above the national average.

Fossil-fuel industries are defined as those that deal in the “extraction, processing, transportation, or storage of coal, oil, or natural gas.”

How do you determine the unemployment rate for a region? The Bureau of Labor Statistics releases the previous year’s unemployment data annually, usually around mid-year. Because economies and communities are always changing, it’s important to check the latest data for the region, or statistical area, where your project is located.

A statistical area can either be a metropolitan statistical area (MSA) or a non-MSA. An MSA is simply a geographic entity based on a county or a group of counties, with at least one urbanized area with a population of at least 50,000 and adjacent counties with economic ties to the central area.

That’s a mouthful, but all you need to know is that it’s a region that’s bigger than a city but smaller than a state.

Coal Closure Category

Your project qualifies for the coal closure category if it’s in a census tract or directly adjoining a census tract with either a coal mine that closed after December 31, 1999, or a plant that generated electricity by burning coal that closed after December 31, 2009.

You may think there are no closed-down coal mines or coal-burning plants near your project, but the fact that a site in an adjacent census tract will qualify your project means that there are more possibilities for this adder than are apparent at first glance.

Eligibility Map to the Rescue

This may seem like a lot of information to sort through, but fortunately, you can check your project’s eligibility for the statistical area and coal closure categories on a convenient Energy Community map. Brownfields are not included in the map.

On this map, the eligible statistical areas are the ones shown in purple; the areas in orange are coal closure areas. By entering your project’s address in the map, you can easily see if it’s in either type of area.

Two key takeaways from this map:

- The purple statistical areas may shift every year, so be sure to check the latest map. If your project is starting construction or will be placed in service before the next map comes out, it should qualify. More details will be provided in the proposed regulations for the adder when those are released, but for now, the guidance says that the set of data provided is good until the next data set comes out.

- Check the map even if you think your project might not be eligible. We’re not talking only West Virginia, or only low-income sites.

An example of a location that you wouldn’t expect to be eligible is the Getty Center in Los Angeles, which is a very well-funded nonprofit in a posh hilltop location that you might not associate with a “low-income neighborhood”.

But a project sited there would qualify for the adder, because it’s in the middle of a large eligible statistical area:

What comes next

It’s important to remember that we’re still in the early stages of the guidance for the Energy Community Bonus Adder. You can begin to use the current guidance to develop projects, but the upcoming proposed regulations and final regulations, expected in early 2024, may still change some of the requirements. Be sure to check for the latest regulations when planning your project.

You can learn more about the Energy Community Bonus Adder by viewing the recording and slides for our webinar that aired on October 19, 2023. If you have questions about this adder, or any of the other IRA adders, don’t hesitate to reach out to CollectiveSun.

This information does not constitute legal or tax advice and should not be relied upon for any purpose. Please consult your legal counsel and tax advisor.