solar financing options for nonprofits

how collectivesun can help

Financing can be one of the biggest hurdles for a solar project. But it doesn’t have to hold back your project.

CollectiveSun specializes in financing! Because we are committed to increasing access to solar financing for nonprofits, we go beyond helping you navigate the options — we can also finance your project, if that’s the route you choose.

Nonprofits have always faced barriers when trying to access traditional sources of financing. Banks and other lenders have a biased perception about the risk of lending to nonprofits, which has made it difficult for nonprofits to access loans from traditional banks at attractive rates. CollectiveSun is removing these financing barriers.

Every nonprofit is unique, so nonprofits need a diverse range of financing options. We offer both loans and third-party ownership options to make solar energy more accessible and cost-effective for your nonprofit.

solar loans

A lending option may make sense for a nonprofit that wants to own its system but does not have the cash to purchase it outright.

The CollectiveSun Solar Loan — designed by nonprofit professionals, not traditional bankers — supports your nonprofit’s purchase of a solar system while allowing you to benefit directly from the Inflation Reduction Act’s direct pay tax rebate. Our loan options include the SunForAll Solar Fund.

CollectiveSun’s interest rates are based on community impact, not just your nonprofit’s credit score. The approval process is quick and easy, and our loans come with fund control, which is a construction management process where we disburse loan proceeds according to a milestone schedule in order to protect the nonprofit organization.

Solar Power Agreements: the Easy Button

CollectiveSun also offers third-party financing options as a solar subscription that make it easy for nonprofits to go solar — our “Easy Button” options.

While your organization won’t own the solar panels with these options, you’ll own all the energy they generate. CollectiveSun provides all construction management as well as full operations and maintenance, so you don’t have to worry about those risks. Leaving it to the experts means that it’s somebody else’s problem when things go wrong during the construction process, and somebody else takes on the long-term ownership risks. As with our Solar Loan, our solar subscription rates are based on community impact rather than credit scores.

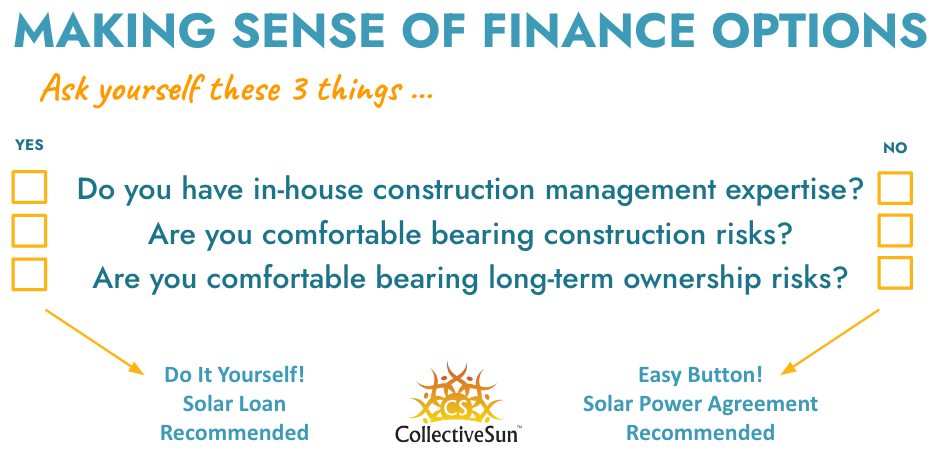

Picking the Right Financing Option for Your Nonprofit

Solar projects are construction projects, and with the tax rebates involved, the financing and tax filing can be complex. Your organization may be willing and able to handle all of that; if not, CollectiveSun can take care of it when you pick third-party financing through us.

If your nonprofit prefers to own your system, you may choose to finance it with a loan or cash. Keep in mind these important caveats:

- Your organization must have construction management expertise and be comfortable navigating the tax filing requirements.

- You’ll need to find solar installers and compare their quotes. If the installer you select for your project has not yet been vetted by CollectiveSun, that installer must submit a contractor application and meet our vetting requirements.

- You should be comfortable monitoring your solar system and handling any required maintenance, even if that means hiring contractors to do the maintenance.

- All of this work must be built into your budget for the project.

- You may need to rely on volunteers from your nonprofit or congregation to manage some of the work.

- If something goes wrong during construction, you will be responsible for managing insurance claims, finding a new contractor (if your selected installer becomes insolvent), and dealing with construction management hassles.

If your nonprofit is not well equipped to manage construction, financing, and maintenance, you might opt for the Easy Button “Solar Subscription” solution of a Solar Power Agreement. This option provides benefits beyond requiring no cash upfront. CollectiveSun will also select a vetted installer, undertake all contract negotiations, take care of tax filings, and provide monitoring and maintenance.

This figure can guide your nonprofit in picking the right solar financing option: