The Devil Is in the Direct Pay Details: Understanding This Boon for Nonprofits Going Solar

|

At CollectiveSun, we’ve been closely following the policy innovations in the Inflation Reduction Act (IRA) that are making it easier for nonprofits to go solar. One of these is the legislation’s direct pay provision, which for the first time allows nonprofits to receive a payment that’s equal to the full value of tax credits when they build qualifying clean energy projects.

We’ve already provided an overview of direct pay. Because it’s such a significant provision for nonprofits, we’re digging into the details here. This article covers the proposed regulations as of February 22, 2024; the final regulations are still to come, so if you’re reading this at a later date, be sure to check for the latest Treasury guidance (the IRS refers to direct pay as “elective pay”).

What you need to know now: Timing is key

For your project to be eligible for direct pay, the timing has to be right. To claim direct pay in your 2023 tax filing, your project must have been placed in service in 2023. That means that regardless of when the project was started, if it was placed in service on December 31, 2022, or earlier, it would not be eligible.

When is a system considered to be placed in service? There is no language in the regulations to specify exactly what “placed in service” means for a solar project. It’s a very facts and circumstances-based determination. Some people interpret it as the point of substantial completion, others use the commercial operations date as certified by an installer. A popular option is to go by the Utility permission to operate (PTO) date, because it comes with third-party attestation. There may be arguments for different approaches, though; it’s crucial to discuss this with your tax advisor to determine what’s best for your project.

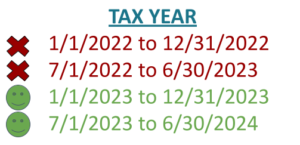

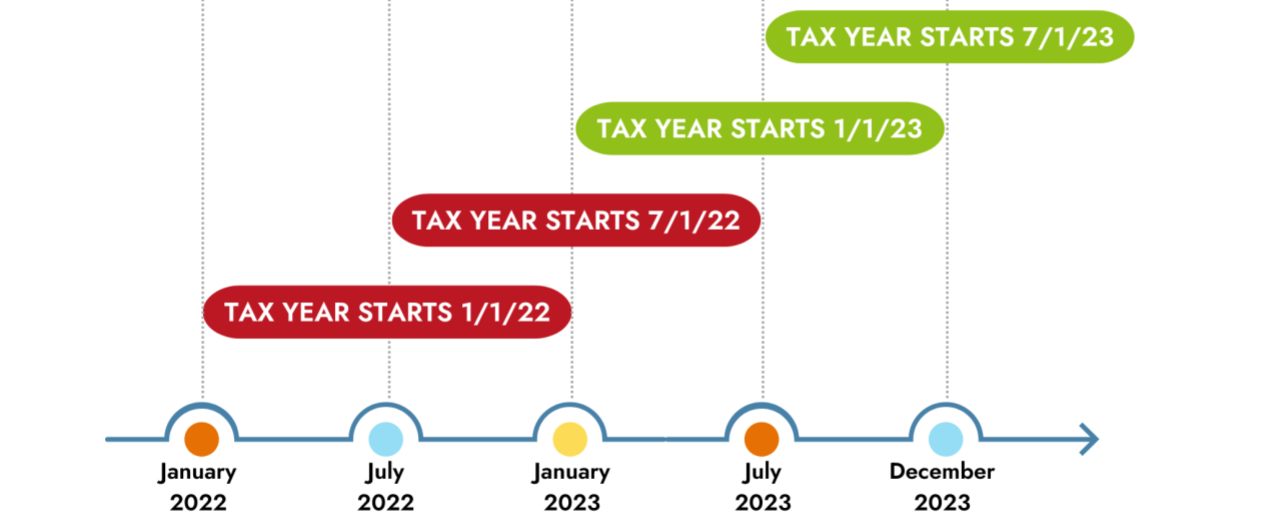

The timing of your solar project is not the only consideration; a lot also hinges on your nonprofit’s tax year. If your tax year is the same as the calendar year, then all you need to know is that to be eligible for direct pay, your project must be placed in service starting in 2023 or later. But many nonprofits have tax years that start on July 1. For your project to be eligible with a tax year that starts on July 1, it must be placed in service on or after July 1, 2023.

This may seem like a lot to absorb. Treasury is aware of the complexity of the regulations and the potential timing issues for nonprofits, and the final regulations will provide further guidance on this aspect of direct pay.

Pre-filing registration process

The IRS opened a portal in December 2023 for pre-filing registration. You must register at this portal in advance to later claim direct pay for your project. After Treasury review , a registration number will be issued which needs to be included in your tax return, but this does not constitute approval of your direct pay request; it simply makes you eligible to request the direct pay benefit when you file your tax return.

You can’t register for pre-filing until your project is placed in service. However, it may take up to 120 days between when you register and when you are issued a number that you can use on your tax return to claim direct pay. To avoid delays, it’s a good idea to complete this step as soon as your project is placed in service, even if you won’t be filing your tax forms for some time.

To help organizations with the portal, the IRS has announced office hours in a range of dates through April 24, 2024. This initiative is designed to provide general assistance with the pre-filing registration process for direct pay; tax policy and specific interpretation guidance is not offered in these sessions.

Who files the forms? When and what do you file?

Direct pay is available to tax-exempt entities such as governments, tribal nations, and religious organizations. Even if your organization is not required to file a regular tax form or has never filed a tax form of any kind, some tax forms will need to be filed for your project to get direct pay.

Who files?

- If your nonprofit will be the owner of the solar system, you need to file the forms. Our recent webinar covers more details about the forms and some of the credits; as always, you should consult with your tax advisor when filing.

- If you’re leasing the system, the third party you lease from is responsible for filing the forms. CollectiveSun offers both ownership and leasing options to finance solar projects. If you pick our leasing option, we will take care of the tax filings.

When do you file?

If your organization does not normally file taxes and therefore does not have a tax year, the regulations indicate that you should follow your accounting year. If for some reason you don’t have an accounting year, you can use the calendar year.

What do you file?

Most 501(c)(3) nonprofits are required to file an informational form known as Form 990. Religious organizations are exempt from filing this return. However, even religious organizations have been required to file a Form 990-T if they have gross income of $1,000 or more that’s unrelated to their exempt purpose, also known as “Unrelated Business Income Taxes”, or “UBIT”. The 990-T has been around for a long time, but many nonprofits have never had to file it because they’ve never had unrelated business income.

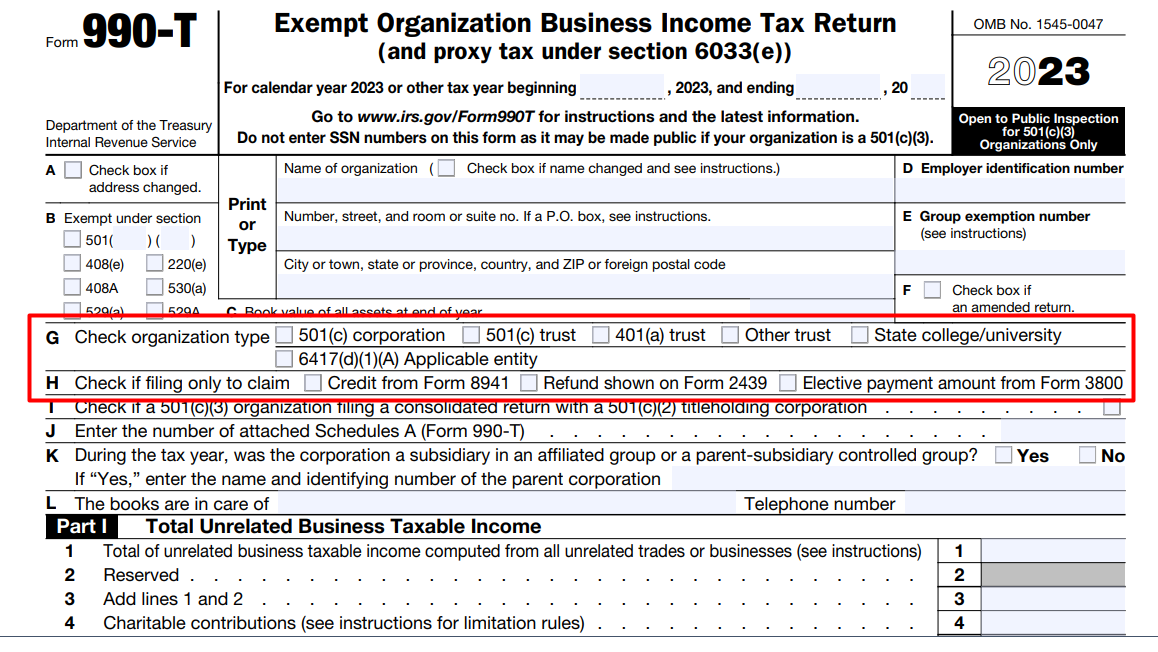

Now, to claim direct pay, all nonprofits must file Form 990-T, in addition to two other forms:

- Form 3468: This form covers a number of different kinds of credits, including the solar energy credits that are eligible for direct pay. This form is also where bonus adders are selected, such as the domestic content bonus adder, the energy community bonus adder, and the low-income communities bonus adder.

- Form 3800: This form, which covers general business credits, is the next step in the process, where you enter the credit from Form 3468.

Form 990-T: This form now includes a checkbox for organizations that don’t normally file a 990-T such a government, municipal and tribal entities. There’s also a box to check if you’re filing the form only to get the tax credit for a solar project, labeled “Elective payment amount from Form 3800.”

Before filling out these forms, you should determine which credits and adders your project is eligible for. Keep in mind that there will be a gap between when you file the forms and when you receive the tax credit, as detailed in this article.

Learn more

For more direct pay details, see our recent webinar as well as our direct pay overview.

We’ve also conducted webinars on key IRA bonus adders that increase the Investment Tax Credit (ITC) amount and cut project costs for nonprofits even more. These webinars are summarized and linked to in the following blog posts:

Disclaimer: This information does not constitute legal or tax advice and should not be relied upon for any purpose. Please consult your legal counsel and tax advisor.