After helping hundreds of nonprofit organizations fund and construct solar projects, at CollectiveSun we have developed a deep understanding of how to craft the best financing options available, based on the uniqueness of each organization we serve.

But most nonprofits who want to go solar have never embarked on a solar project before. And there’s no one-size-fits-all solution. With various financing options to pick from, how do you find the right one for your nonprofit?

To help you make the right decision for your organization, we’re providing this overview of solar financing for nonprofits.

Financing options

There are three ways your nonprofit can finance a solar project, two of which CollectiveSun provides and can help you with:

- Cash. If your nonprofit has large reserves or can find a grant or gift for your solar project, you may be able to purchase your system with cash.

- A solar loan. The CollectiveSun Solar Loan — designed by nonprofit professionals, not traditional bankers — supports your nonprofit’s purchase of a solar system while allowing you to benefit directly from the Inflation Reduction Act’s direct pay tax rebate.

- Third-party ownership. Our Solar Power Agreement (SPA) subscription and Prepaid SPA are third-party ownership options that make it easy for your nonprofit to go solar.

Our financing options are tailored to nonprofit organizations, with safeguards in place at every stage of the solar construction process to mitigate risks and protect nonprofits. You can read more about them in Financing Solar for Your Nonprofit.

Factors to consider

How do you decide which solar financing option is right for your organization? Every nonprofit is unique, so that depends on your situation. You’ll want to consider these factors:

- Costs. It’s not just about how much your system will cost — you also need to consider whether your nonprofit can afford the upfront cost, or if you are more comfortable spreading the cost out over time.

- Savings. Spending more upfront may save your nonprofit more in the long term — but even if you don’t have upfront funds to allocate to a solar project, solar savings are still available regardless of which method you choose to finance your project.

- Cash flow. While paying for your system with cash brings some benefits, it also ties up dollars that you could be using for your programs or other organizational needs.

- Risks and responsibilities. If you choose to manage and own your solar project with a cash purchase, that comes with risks and responsibilities that your organization must be prepared to handle.

Costs, savings, and benefits

Nonprofits across the nation are saving money with solar and using those savings to power their missions. How much money your nonprofit can save depends on many factors, such as electricity costs and solar policies in your area. How you finance your project will also affect your costs and savings:

- Cash purchase, the DIY financing option: If you pay cash for your system, your organization will own the solar panels, you’ll get the full tax credit, and you’ll enjoy the greatest long-term savings with solar. That’s because you won’t have loan or solar subscription payments.

- Solar Loan, CollectiveSun’s “Guided Ownership” option: If your organization doesn’t want or can’t afford the large upfront cash payment, you can opt for a solar loan and still own your solar panels. You will start saving from day one, and this option frees up your cash so you can use it — plus your solar savings — to support your nonprofit’s programs, all while receiving the benefits of CollectiveSun’s guidance throughout the construction and tax filing process.

- Solar Power Agreement (SPA), our “Easy Button” option: An SPA subscription or Prepaid SPA may make sense for your organization if you also want to start saving from day one and free up your cash, but your organization is not comfortable with the responsibilities of owning and operating your system.

To compare how each option will look for your nonprofit, you can get free detailed solar quotes that will lay out your costs and estimate your savings — or reach out to CollectiveSun directly.

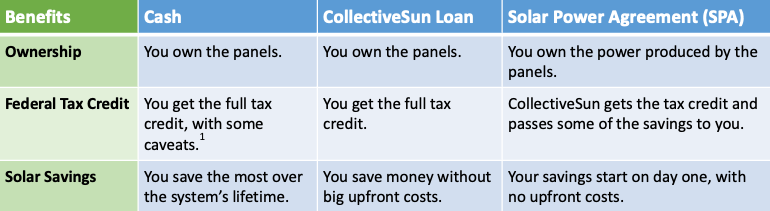

This table provides a high-level overview of the benefits of each financing option:

1. If you pay for your solar with a grant earmarked for solar, the “Excessive Benefit” rules may limit your ability to claim the tax credit through direct pay. The direct pay eligible amount is reduced to the extent that the restricted tax-exempt amount plus the direct pay tax rebate exceeds the purchase price. For example, if your system costs $100,000 and is otherwise eligible for a 30% ITC, any amount of grants earmarked for solar over $70,000 will lower the direct pay rebate eligibility. If you received a grant for $100,000, the system would not be eligible for any direct pay rebate.

Risks and responsibilities

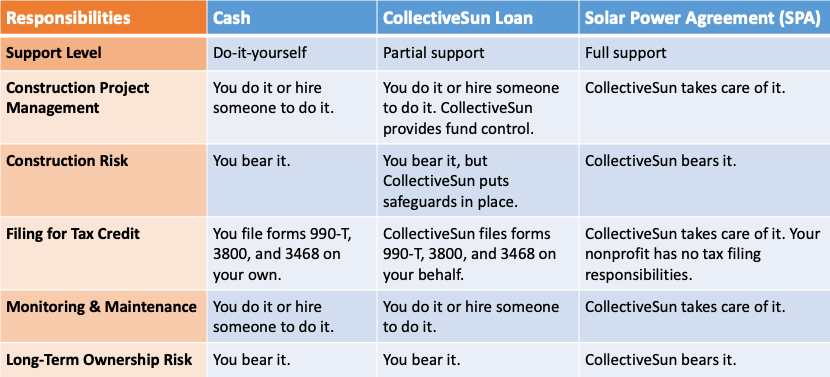

In deciding on a financing option, your nonprofit should consider how comfortable you are managing a construction project — and the risks associated with both managing the project and owning the solar installation.

We’ll start with a high-level overview of the responsibilities involved and the support we provide for each option; read on for more details.

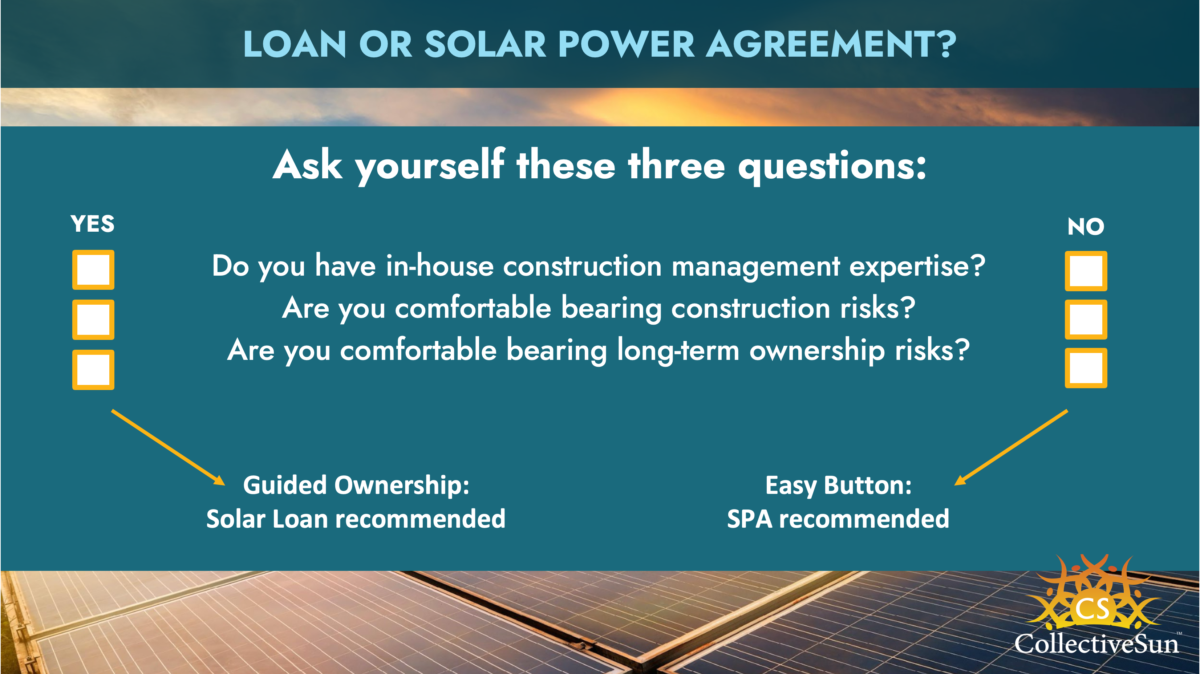

If your nonprofit prefers not to purchase your system with cash, you still have some decisions to make. These questions make it simple to choose between CollectiveSun’s Solar Loan and our Solar Power Agreement (SPA):

Of course, each financing option has its pros and cons, and the details are important to understand.

Cash purchase, the DIY financing option

Purchasing your solar system with cash may be a good option for your nonprofit if you’re comfortable finding a solar installer; engaging in a competitive bidding process; managing the construction process; completing and filing forms 990-T, 3800, and 3468 with the IRS; and taking on any monitoring and maintenance needed after the system is installed.

- Your organization must have construction management expertise and be comfortable navigating the tax filing requirements.

- You’ll need to find solar installers and compare their quotes.

- You’ll have to deal with any construction management hassles that arise; if something goes wrong during construction, you will be responsible for managing insurance claims and potentially finding a new contractor, if your selected installer becomes insolvent.

- You should be comfortable monitoring your solar system and handling any required maintenance, even if that means hiring contractors to do the maintenance; you may be able to purchase a maintenance contract with your solar installer.

- All of this work must be built into your budget for the project.

Solar Loan, CollectiveSun’s partial-support option

If owning the panels is important to your nonprofit, you don’t want to tie up your cash, and you want more safeguards than if you bought your system with cash, your nonprofit may opt for CollectiveSun’s Solar Loan option. Keep these factors in mind:

- While we don’t provide full construction management with our loans, they do come with fund control, which is a construction management process where we disburse loan proceeds according to a milestone schedule to protect your nonprofit.

- For our Solar Loans, we require that contractors meet CollectiveSun’s rigorous vetting requirements. That includes verifying that the contractor license(s) are valid in the state they were issued.

- We will take care of federal tax filings, making it simple for your nonprofit to benefit from the Inflation Reduction Act’s direct pay tax provision.

- As with a cash purchase, with a Solar Loan your nonprofit is responsible for monitoring and maintaining your system, but you may be able to purchase a maintenance contract with your solar installer.

Solar Power Agreement (SPA), our full-support or “Easy Button” option

With an SPA, your organization won’t own the solar panels, but you’ll own all the energy they generate. In addition, you’ll get these benefits, all included with your SPA:

- CollectiveSun negotiates the installation price, taking advantage of economies of scale to get lower pricing.

- CollectiveSun manages the entire construction process, including all the paperwork: invoices, preliminary notices, lien releases, signatures, and contracts.

- We protect our nonprofit partners by requiring builder’s risk insurance to protect the equipment when it is on site but not yet installed, in transit, and in storage.

- During construction of a solar project, we disburse payments to the solar contractor according to a construction milestone schedule, ensuring the panels are correctly installed and the correct lien waivers are in place. Leaving it to the experts means that when things go wrong during construction, you have an expert managing the process.

- In addition to providing construction management, we take care of all operations and maintenance, so you don’t have to worry about those risks.

- As with our Solar Loan, we’ll take care of all tax filings, and pass tax savings along to your organization.

Getting help with your choice

We’ve provided a lot of information here, and it may seem overwhelming if you’re not familiar with the process of financing and building a solar project. If you would like some guidance when choosing how to finance your nonprofit’s solar project, don’t hesitate to reach out to us.