The Inflation Reduction Act (IRA), passed over a year ago, is expected to increase U.S. solar deployment fivefold. To live up to this promise, the law must do more than incentivize additional project build-outs. It must also support domestic manufacturing of the components that go into those projects.

The role of the domestic content bonus adder

We need more domestic manufacturing capacity because of the volatility of international supply chains. Solar supply chains have recently been affected by concerns about forced labor in China’s Xinjiang Province, a Commerce Department ruling on panels imported from four countries in Southeast Asia, and even the war in Ukraine.

Fortunately, the U.S. solar industry is seeing some rebound as supply chain bottlenecks ease. Q1 2023 was solar’s best first quarter in history, and the market is expected to triple in size over the next five years.

But to achieve that increase and to meet our nation’s clean energy goals, we’ll need a much larger supply of solar panels. It’s imperative that we strengthen our domestic solar manufacturing.

That’s where the domestic content bonus adder comes in.

How the domestic content bonus adder works

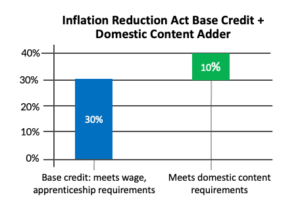

The IRA incentivizes solar development by offering tax credits that can add up to a significant percentage of a solar project’s cost. It starts with a base 30% Investment Tax Credit for projects that meet certain labor requirements. That amounts to getting a 30% discount on the cost of your project. Then it offers various adders to that base credit — including the domestic content bonus adder, which can add another 10% tax credit (in other words, savings) to your project.

Sounds simple, right?

Not surprisingly, the reality is not so simple — for two reasons. The first is that factories take time to build. We simply don’t have enough domestic solar manufacturing yet for many projects to qualify for this adder.

The second reason is that under this year’s Treasury guidance on the adder, it’s tricky to qualify. It’s not enough for your panels or other components of your project to be assembled in the U.S. — a certain percentage of the materials in the products must also be U.S.-made.

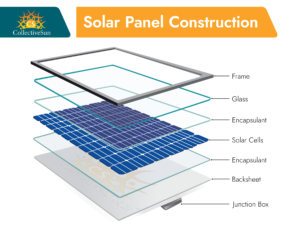

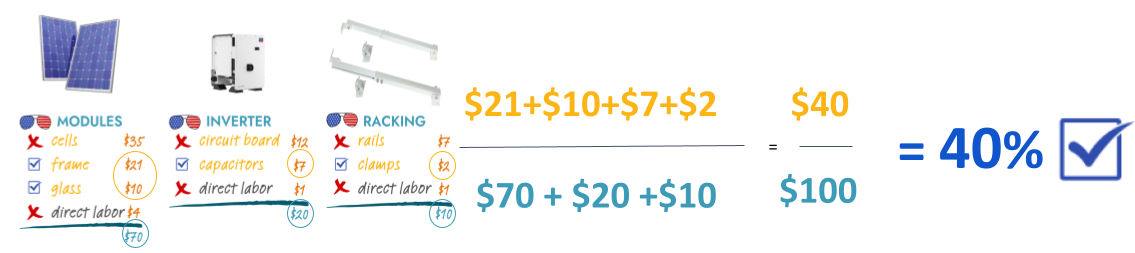

The main products that make up a solar project are the panels (or modules), inverters, and racking. Let’s look at just one of these components: panels. Solar panels are made of a number of components, as shown in this illustration:

Even if the panels are assembled in the U.S., some or all of these components might not be made here.

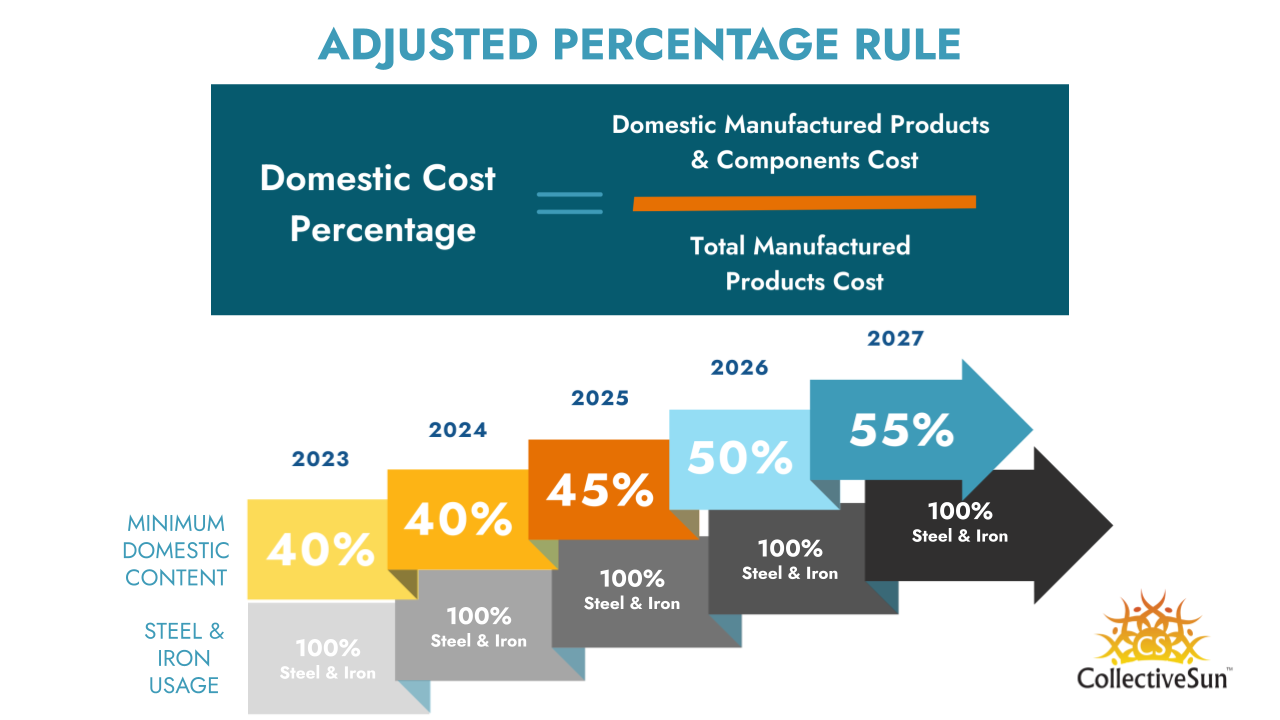

The Treasury guidance acknowledges this issue by phasing in the domestic content requirement. This applies to everything but the steel and iron used in structural components for a project, such as in solar canopy structures, which must be 100% domestically manufactured. For everything else, through 2024, only 40% of a project’s components need to be manufactured domestically to meet the domestic content bonus adder requirements. Percentages are based on the cost of the components to the manufacturer (not to the developer or the ultimate end user), so the percentage is known as the domestic cost percentage.

After 2024, the domestic cost percentage increases annually. As the percentage goes up, more domestic solar manufacturing is expected to become available, making it easier to meet these requirements.

Even a 40% requirement may be tough to meet in today’s market, but there is a silver lining: the percentage applies to your whole project, not to a specific product in your project. Let’s say your inverters don’t have a 40% domestic cost percentage, but some of the other, more expensive components have a larger cost percentage. Your project could still qualify.

The following example shows how this could work — in this example, 40% of the cost of the components used for the project are domestically manufactured.

You might notice that “direct labor” doesn’t count toward the total domestic content amount in this example. That’s because direct labor can only be counted if 100% of the components of a product are U.S.-made.

As you can see, the current guidance is complex, and it does take some math to see if you qualify. CollectiveSun has created a calculator to determine if a project qualifies, which you can view here. The calculator uses the example of a party to keep things simple; imagine the cake is your solar panels, the forks are the inverters, and the plate is the racking. (This calculator does not constitute legal or tax advice and should not be relied upon; it is offered for educational purposes only.)

Since the amounts are based on the cost to the manufacturer, how do you get that information? Most manufacturers don’t want to give you their cost breakdowns. Again, there’s a silver lining. You don’t need to have the exact numbers, as long as you have the percentage for each product. Many manufacturers are willing to provide this percentage information. If each product’s domestic cost percentage is 40% or more, you know your project qualifies.

Moving forward with the domestic content bonus adder

While the domestic content bonus adder may help stimulate domestic solar manufacturing, in this early stage it’s complicated and could be tricky to qualify for. However, the guidance from the Department of Treasury is just that: guidance. The forthcoming regulations, expected in early 2024, may include changes to this guidance. We hope that will provide more flexibility and time to enable domestic solar manufacturing to flourish.

In the meantime, you can make things easier for your nonprofit by working with CollectiveSun. Through our SunForAll Solar Fund, we offer loans and leases to nonprofits nationwide.

Our Solar Loans let nonprofits take advantage of the IRA’s direct pay provision without needing to pay anything up front. If you choose this option, be prepared to take on the domestic content bonus adder math, in addition to managing a complex construction project. Alternatively, you can choose CollectiveSun’s “Easy Button” solution, the SunForAll Solar Lease. With this option, we do all the heavy lifting for your project — including the math.

Because all nonprofits are different, there’s no one-size-fits-all solution. That’s why we have various options for you to choose from. Whichever one you choose, to learn more about the domestic content bonus adder, see our recent webinar.

This information does not constitute legal or tax advice and should not be relied upon for any purpose. Please consult your legal counsel and tax advisor.